By F. Burmester, H. Berg, M. Rolfs (joint article by M2P Consulting and Lufthansa Consulting)

Which trends will influence pilot demand and how can the airline industry prepare?

If we fade out the corona pandemic for a moment and recall the news about pilot shortage from two years ago, the picture was clear and transparent:

Pilots urgently needed!

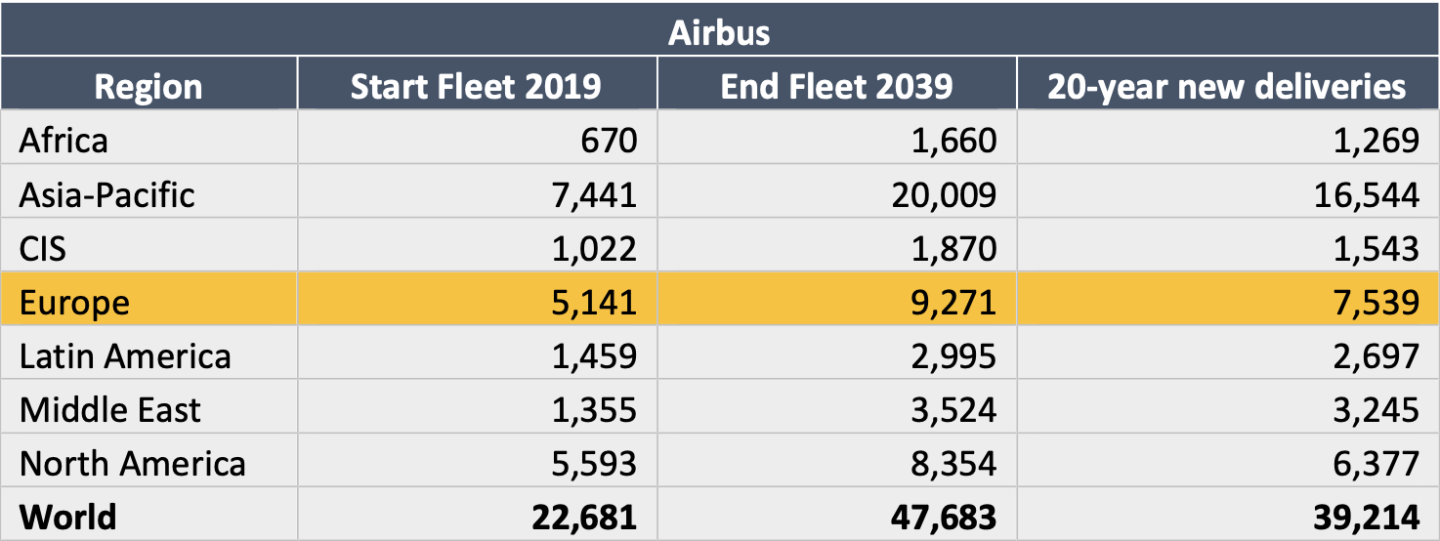

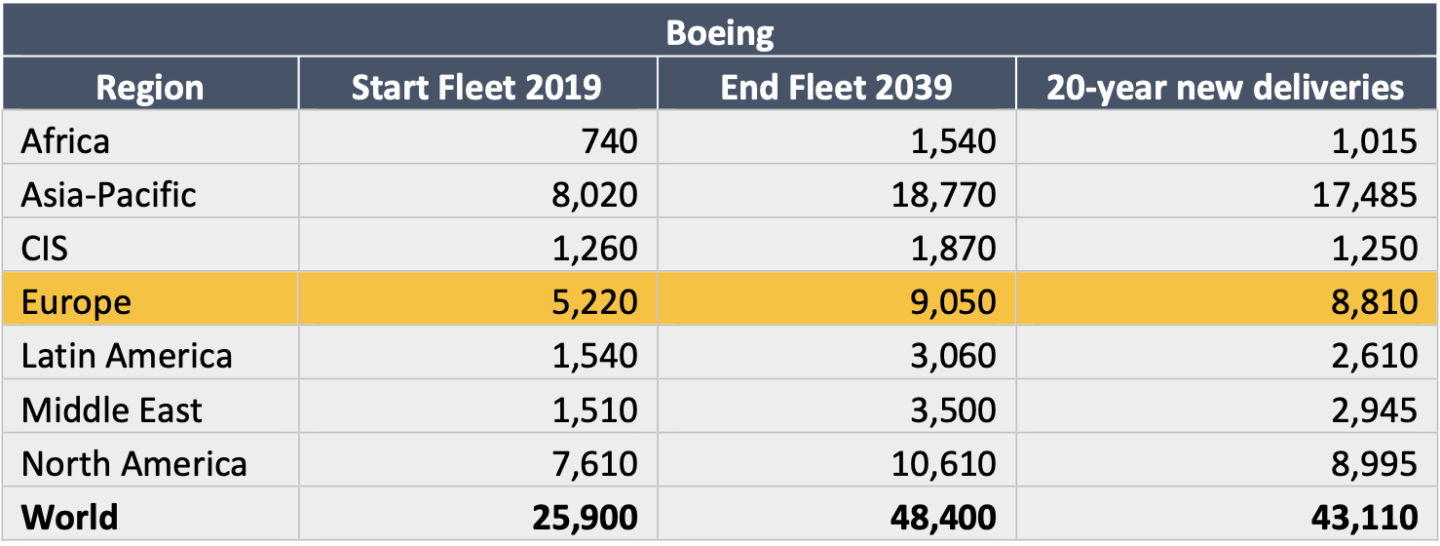

The two main rivals at the aircraft manufacturer market, Airbus and Boeing were united in their forecast: In September 2019, so just before the pandemic hit, Airbus and Boeing predicted that the number of aircraft would more than double within the next twenty years. The biggest growth would be in Asia Pacific, second would be in Europe. New airlines were projected and corresponding traffic growth.

As these aircraft orders are the key indicator for airline resource planning, the demand for pilots can roughly be derived. Airbus predicted a global need for 550,000 new pilots for the upcoming two decades. Boeing ́s estimation within this period amounted to 605,000 new commercial pilots worldwide.

Following the aircraft orders, the demand is by no means equally distributed on a global scale. Looking at Europe, Boeing has estimated that between 2020 and 2039, there would be a need for 115,000 new airline pilots – equating to 5,750 new pilots per year.

The response of the airlines was obvious: The Lufthansa Pilot School increased capacity from 300 to 500 student pilots in 2018. Emirates Group opened an own pilot school in 2017 with a capacity of 600 student pilots. Qantas und American also launched own training programs.

Then came Corona…

Passenger traffic basically came to a stand-still overnight in most parts of the world. Just cargo flights ensured the remaining flow of goods to transport health and safety equipment in the first weeks and months and keep a minimum value chain alive for the global economy. Thousands of pilots were laid off. This process is still ongoing and also in 2022 it can be expected that airlines in Europe will furlough cockpit staff.

The current disruption in commercial aviation will push forward current airline fleet strategies for fleet renewal, not for growth. The trend to phase out four-engine aircraft was obvious already before the pandemic, but now there are fast decisions and executions. In average years, 2-3% of the aircraft fleet retires annually. In past industry downturns this rate has risen to 4-5%, so this can be expected for the pandemic as well. The overarching airline strategy will focus on versatile fleets that provide network flexibility with an improved efficiency and sustainability.

What is the impact on pilot demand?

Assuming the return of a pre-pandemic traffic volume, one could argue that the operation with smaller aircraft means ceteris paribus more flights and higher frequencies are needed to offer the same capacity, so more pilots will be needed on those smaller aircraft types.

Is there really a pilot shortage? Maybe it just needs re-qualification for the needed aircraft types.

In the following section, we will take a deeper look at the situation in Europe and what trends can be derived for the next months post-crisis.

Let ́s begin with a small but important differentiation: License vs Type Rating (TR)

License simply means a permit from a Civil Aviation Authority (CAA), e.g. the “Air Transport Pilot License” (ATPL). This is what the successful student pilot receives when completing the pilot school. However, some of these licenses, especially the ATPL, are very limited without having ‘ratings’ on the license. A Type Rating allows you to fly an aircraft type and is also awarded by the local CAA. Type

Ratings can be either single-pilot or multi-pilot and are usually valid for a single aircraft type or one aircraft ‘family’, e.g. A320 family which is made up of Airbus A318, A319, A320 and A321. In general, ratings specify what, and/or how, the pilot is qualified to fly. During a typical pilot career, there are certain thresholds when changing aircraft types, e.g. from turbo prop to a jet aircraft or from a narrow body to wide body aircraft.

Now let us combine this theoretical knowledge with the latest industry developments!

First of all, our hypothesis is that there is a sufficient number of licensed pilots in Europe for short and mid-term. The decisive question is how much the post-crisis demand for type ratings on certain aircraft types will differ from the pre-crisis environment? And what would this mean for the stakeholders, airlines, trainings organizations, student pilots and regulators?

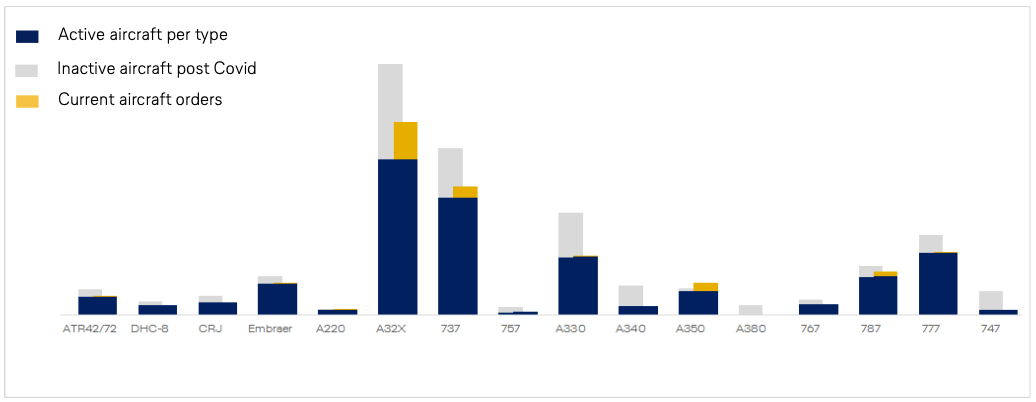

Looking at the current active aircraft, the inactive post-Covid fleets, and the pending orders in Europe, it is apparent that a shift of a large number of pilots to a selected number of aircraft types will be necessary. While older and four-engine aircraft in particular were phased out during the crisis (e.g. A330, A340, A380), a significant shift to aircraft types such as the A350, B787 and B777 is already foreseeable.

So – how will the short- to mid-term pilot demand develop after Covid and what does it mean for the industry?

As visible on the chart of active, inactive and ordered aircraft in Europe, combined with the emerging trend towards more fuel-efficient and twin-engine aircraft, a major “type rating jam” is forming across the Corona crisis. Large proportions of cockpit crews have to be retrained – in addition to those who have lost their type rating in recent months due to inactivity or being on furlough. In particular, simulator capacity and the capacity of available training personnel will struggle to keep up with the spontaneous demand from airlines in the aftermath of the crisis.

As an example, the A320 simulator capacity will most likely be sufficient for the upcoming years, while the B777/787 simulator capacity is already tight today and the A350 simulators will most probably also run into shortages within the next five years.

Compared to the general pilot shortage before the crisis, bottlenecks in the short- and midterm will come to light on specific fleets only – whereas on other fleets there will be a surplus of pilots.

And in the long-term?

Nevertheless, in the long-term we will return to a general shortage of pilot resources sooner than we think. It is predicted by players and consultancies in the industry that the situation will emerge again in certain regions no later than 2023. However, with a more rapid recovery, this could be even felt most probably before. The reason for this is not only the above-mentioned point that a fleet renewal to smaller and more efficient aircraft types increases the frequency of flights and thus the number of pilots required.

The general growth trend in the airline industry remains unchanged. According to IATA, the air passenger growth could plausibly be in the range of 3.2% and 5.3% over the next 20 years with Asia Pacific (5%), the Middle East (4,4%) and Africa (4,4%) as the strongest growth regions. Combined with the trend of fleet renewal and smaller aircraft types, even more pilot capacity will be needed.

Eventually, the impact of furloughs, retirements, and defections will create very real challenges for even some of the biggest carriers. Especially in North America, many experienced pilots took early retirement and are unlikely to come back. Younger pilots, who have the least experience and will be among the last to be called back, may enter new professions.

New potential applicants are deciding against entering the pilot career because of the high financial risk and the job situation through the pandemic as they fear being stuck with the costs. This has been reinforced by official publications of unions worldwide, such as BALPA in the UK, to postpone entry into the industry until after the crisis.

Further regional factors have to be additionally taken into account. For example, Asian carriers may attract unemployed or furloughed pilots from other slower-growth regions, such as Europe and Latin America, which could create shortfalls in those regions.

However, there are other mega trends that can counteract the situation and reduce the severity of pilot shortage:

- Non-recovery of the business travel market: Work from home will in future account for around 40% of the average office worker’s week, the greater convenience of virtual connections is further entrenched. Intra-company travel has significantly reduced during the crisis. Zooming will certainly feature largely in substituting for business travel in the first two or three years of this decade. As business travel recovers, the proportional impact of virtual operations will progressively be diluted, but the new online doing-business model is here to stay. Furthermore, many companies have cut their travel budgets due to cost savings, resulting in a reduction of yield for the industry as there is more demand for (premium) economy class than business class.

- The trend of sustainability: Especially amongst the younger generation: The ‘Climate sentiment intensifies’ scenario from IATA is based around a widening and deepening of recent developments in Northern Europe, where consumers have reduced air travel and governments have introduced carbon taxes on air travel

- Single-Piloting: The single-pilot concept would reduce crews needed on long-haul flights. This would cut the number of pilots from three or four to just two, with alternating rest periods during the long-haul operation. Airbus is already collaborating with Cathay on a single-pilot system for long-haul. So maybe not so far away in the future anymore? Obviously, there are certain constraints and roadblocks which have to be addressed before any certification and implementation. Beside issues as medical emergencies with one of the pilots, there are challenges like public acceptance.

- Future replacement of aircraft flights by drones: The drone sector appears to have come back particularly strongly in recent times – especially when discovering the transport of cargo, the use of drones is becoming more and more realistic. Although, regulators have been slow to adapt over safety fears and reflecting the public’s caution over pilotless aircraft, in a few years new innovations will bring us closer to this topic. Potentially, one day cargo transport could be operated without human pilot intervention.

Depending on how strongly these trends play out, a new shortage will be delayed – inevitably, however, it will come again and therefore market players should also prepare themselves for the future challenge.

Coming back to today’s situation – what does this “type-rating jam” mean for the airlines, trainings organizations, student pilots?

Impact and suggestions for airlines:

For airlines, a pilot shortage on certain fleets has for sure the most serious implications. Too few pilots could translate into flight cancellations, fewer routes and a lower market share. This could consequently mean higher fares to make up for the drop in revenue. A supply shortage might also mean higher pilot salaries. Even before Covid-19, the latest round of contract negotiations between airlines and the pilot union saw upward pressure on salaries. The higher cost would be a heavy burden for airlines at a time when financials are not looking strong.

Short and mid-term suggestions for airlines:

- Constantly reassess the training scenarios for the ramp-up to identify bottlenecks and critical paths to achieve the new normal. As legacy systems are often not capable of managing this new complexity, the utilization of new technologies, optimization and better prediction can help derive the cost-optimal scenario and manage risks proactively.

- Create a solid plan to re-train pilots on the new fleets and ensure that this gets reflected correctly in the manpower plans. The training assumptions and buffers in the planning must be adjusted accordingly. If this is not done sufficiently, the training concept will fail due to insufficient budget assumptions

- Get hold of frequently used SIM and secure your SIM slots in training centers – competition will increase!

Long-term suggestions for airlines:

- Increase collaboration with Approved Training Organization (ATOs) to strategically focus on Type Ratings in demand

- Reinforce the pipeline by continuing to invest in training programs and pilot recruitment

- Extend the financial support for training programs for new pilots

- Invest in employee engagement to retain staff, e.g. by offering attractive bidding concepts that are not only based on seniority, but consider other factors – making it even more attractive for new pilots to join the company

- Rethink crew operations to increase efficiency so fewer pilots will be needed in the long-term

Impact and suggestions for the Approved Training Organizations (ATO):

As outlined, the training focus in Europe will be on conversion trainings for different aircraft types. In contrast, there will be basically no training of new ab-initio pilots for the first type rating. This is also based on our research showing that currently hardly any airline in Europe is recruiting young pilots from pilot schools. The clear trend in European flight training organizations for the next months is that type rating trainings will be mainly driven by transitions to smaller and/or more modern aircraft types.

Short and mid-term suggestions for ATOs:

- Prepare the capacity and have simulators (SIM) available for the upcoming needed aircraft types

- Prepare resources to have sufficient Type Rating Instructors (TRI) and Type Rating Examiners (TRE) available for future demand

- Prepare future clients (pilots and airlines) for a “backwards” career in some cases, meaning moving from large aircraft type to smaller aircraft type

Long-term suggestions for ATOs:

- Lower the entry barrier for the pilot career and work jointly with the airlines to offer attractive career packages

- Collaborate across the industry to define alternative training concepts and to reduce the complexity of training planning and type ratings – the current process is far too long to respond to situations like pandemics

Impact for student pilots and people interested in becoming a pilot:

For the upcoming five years, we do not expect substantial demand for ab-initio pilots in Europe. First it would need the aviation sector to return on its growth path. According to industry experts this will probably take rather longer than currently expected.

After the booming years, there are a lot of pilots between the ages of 25 and 35 who have been made redundant in the current crisis with a total flight experience of more than 2000 hours on commercial aircraft and are now looking for jobs. On top, hundreds of European pilots, who were flying for airlines in the Middle East are flooding the job market.

Short and mid-term suggestions:

- If you are ambitious to become a pilot, other parts of the world might be more favorable and show a faster return of demand for ab-initio training than Europe, e.g. Asia-Pacific, North America

Long-term suggestions:

- Basically, the odds are in favor of the situation turning around soon and the labor situation recovering quickly. Especially with the necessary flexibility, you can look forward to a positive future with increasing salaries and attractive working conditions

About the authors

Franziska Burmester is a Senior Manager at M2P’s Frankfurt office and has been with M2P since 2014. Her experience with M2P includes extensive work with Airlines, Airports and Rail Operators across the globe. Her primary focus is on improving the operational effectiveness of the clients, specifically on all areas of resource management including an airline’s training organization.

Harald Berg is Managing Consultant for Lufthansa Consulting, based in Frankfurt and has gained vast experience in international project management. His focus is on operational topics, e.g. organization of operations departments, IOCC, SMS, QMS, IOSA, Crew Management, Emergency Response, Regulatory Compliance, EU-Blacklisting (SAFA). His experience includes projects for the Lufthansa Group as well as assignments at international airlines and authorities.

Matthias Rolfs is Consultant for Lufthansa Consulting, based in Frankfurt. He has worked within the aviation industry for ten years and holds a Master’s degree in Strategy and Organization from the University of Southern Denmark. He is a trained airline pilot with Lufthansa Group experience and also gained experience in commercial small aircraft operations. He is member of the Solution Group Flight Operations and Safety Management.

About the companies

M2P is a global management consulting firm based in Frankfurt, Germany, that transforms businesses by accelerating growth through an integrated offering of professional and technological services. We develop innovative strategies, processes, and technology in ways that make sense and create value for our clients. M2P’s product portfolio covers the entire value creation chain across multiple industries. We specialize in Travel, Transportation and Logistics with clients ranging from airlines and airports, training organizations, ground and cargo handlers to retail and government organizations.

Lufthansa Consulting is an aviation and management consulting company, which is dedicated to assist international clients from the aviation sector and related industries to meet the challenges of the future successfully. Since 1988 the company has provided services and solutions to the air transportation industry in more than 3500 projects worldwide and is an independent subsidiary of the Lufthansa Aviation Group (Deutsche Lufthansa AG). Lufthansa Consulting is in the unique position of offering comprehensive consultancy and expertise to aviation specific client groups: air carriers, airport authorities, civil aviation authorities, governments, investors, financial institutions, manufacturers, other industries and service related entities.